“We imagine the Beijing Accord of March 2023 has vital financial and market implications that buyers could have neglected,” he stated in an evaluation on Monday.

“We see vitality representing a extra trade-focused collaboration than seen to this point, with probably extra rapid monetisation potential and thus a faster potential affect on share costs.”

Within the six months instantly after the deal was signed, Saudi Arabia invested US$16 billion within the Chinese language vitality sector, in keeping with information compiled by UBS.

Liu estimated that energy-related commerce between China and the Center East might increase by 10 to 11 per cent by 2030.

For renewables, the extra commerce is anticipated to return from China’s growing inexperienced vitality penetration within the Center East, because the area accelerates its vitality transition by leveraging the nation’s full renewables gear provide chain, in keeping with Liu.

The Center East has been more and more importing renewable vitality modules from China, the world’s largest wind turbine and photo voltaic panel maker. In 2023, China exported 14.5 gigawatts (GW) of photo voltaic modules to the area, up from 11.4GW in 2022, in keeping with information from InfoLink Consulting.

Extra commerce within the petrochemicals sector might come from the bigger market share taken by the Center East and China collectively from Europe, as European factories are more likely to exit the market quicker as a consequence of environmental, social, and governance (ESG) considerations and tight fuel provide, UBS stated.

“The implications of this theme are broad. Chinese language renewables and particularly grid gear gamers are probably the most rapid beneficiaries,” stated Liu.

“European petrochemicals are most in danger from this theme in the long run as larger value bases might strain market share.”

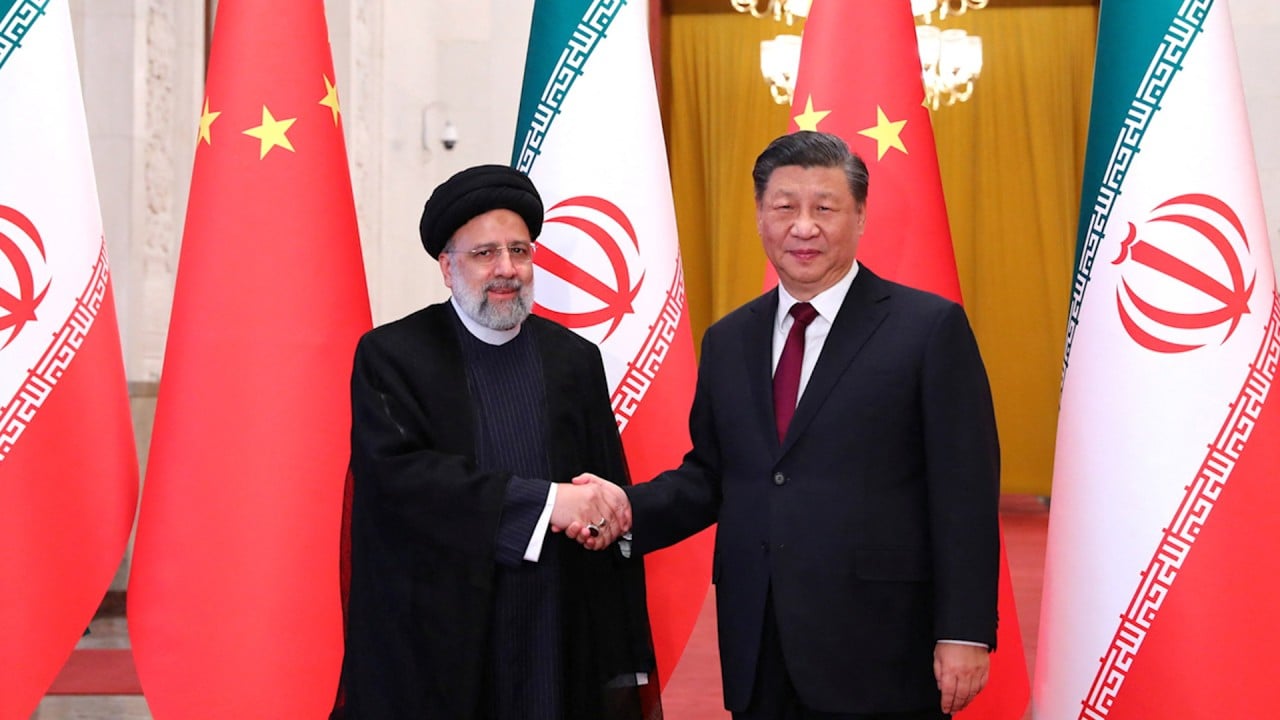

Spearheaded by the Chinese language authorities and endorsed by President Xi Jinping in late 2013, the Belt and Street Initiative goals to enhance commerce and financial integration throughout Asia, Europe, and Africa.