Sanctions by the US and the UK on Russian metals will cement China as Moscow’s purchaser of final resort for key commodities, and improve Shanghai’s function as a venue to set costs for supplies essential to the worldwide economic system.

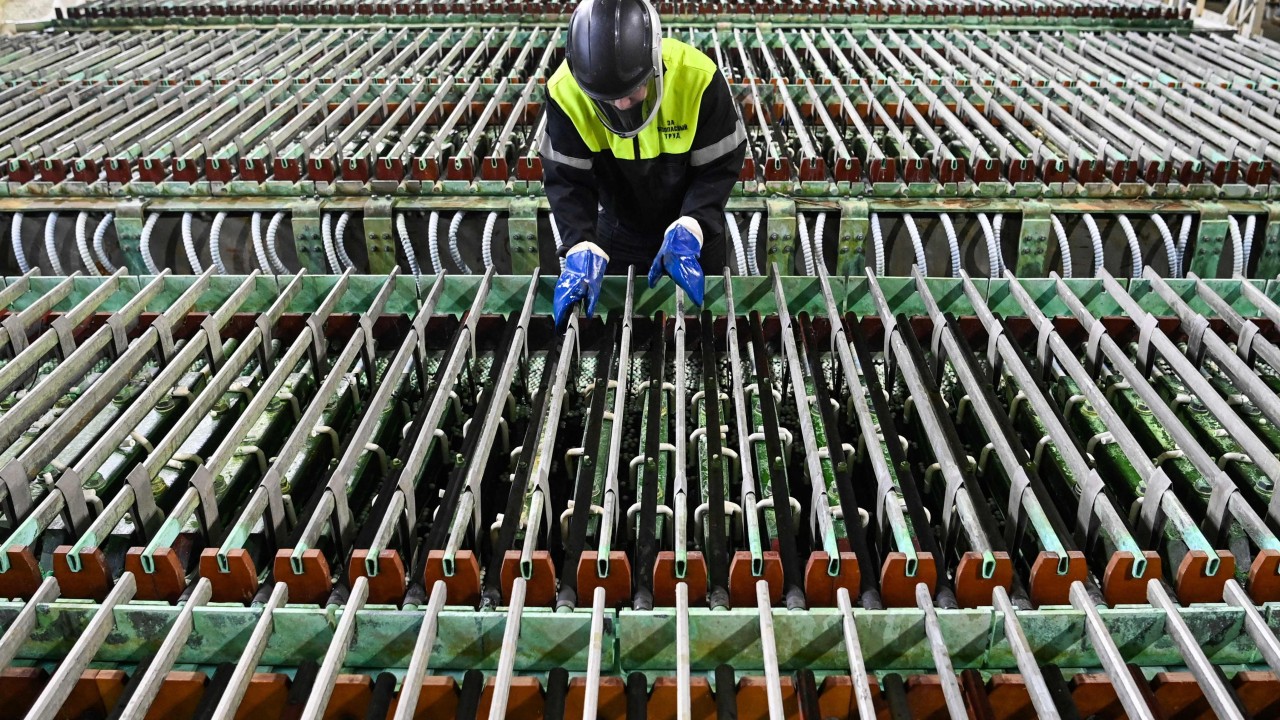

The London Steel Alternate’s ban on newly produced Russian aluminium, copper and nickel is more likely to drive Chinese language imports even larger. It additionally leaves the Shanghai Futures Alternate as the one main commodities bourse on the planet to simply accept Russian shipments of the three metals.

“The liquidity of Russian metals in European and American markets might additional decline, and world commerce flows will even be reshaped,” stated Wang Rong, a senior analyst at Shanghai-based dealer Guotai Junan Futures.

Power market sanctions imposed on Moscow within the wake of its invasion of Ukraine have already had a dramatic influence on China’s shopping for habits. Russia leapt above Saudi Arabia to turn into the largest supply of Chinese language crude oil imports final yr. Additionally it is now No. 2 for coal and is more likely to turn into Beijing’s greatest provider of pure fuel this yr.

Can HKEX-owned LME rebuild its repute a yr after nickel chaos?

Can HKEX-owned LME rebuild its repute a yr after nickel chaos?

Even with out formal sanctions, China’s imports of Russian aluminium have hit file ranges. Russian aluminium big United Rusal Worldwide generated 23 per cent of its income from China final yr, in contrast with simply 8 per cent in 2022. Rusal has additionally taken a 30 per cent stake in a Chinese language alumina plant to plug a niche in provides of the important thing ingredient amid disruptions triggered by the battle in Ukraine.

The brand new sanctions will push extra exports of Russian steel to nations exterior US and UK jurisdictions, particularly China, in line with Guotai Junan. The additional provide will even encourage the export of metals produced in China as extra materials swimming pools inside its borders, the dealer stated in a observe. China is the world’s greatest producer of refined copper and aluminium and a serious participant in nickel by way of investments in Indonesia.

State-owned corporations surge as China’s watchdog pledges market enhancements

State-owned corporations surge as China’s watchdog pledges market enhancements

Chinese language importers have taken benefit of Beijing’s strategic alliance with Moscow to win reductions on key uncooked supplies, paying in yuan to bypass the greenback, the foreign money wherein trades are normally settled. That helped the world’s greatest commodities purchaser stave off the inflationary influence of the battle in Ukraine, in addition to advancing Beijing’s want to unseat the US greenback because the world’s reserve foreign money.

However extra Russian shipments changing into out there at a time when China’s economic system is so sluggish presents its personal issues. Chinese language metals merchants struggled final yr with weak demand and the inexperienced shoots of restoration in markets for gadgets like copper are comparatively latest.

The prospect of extra Russian provides heading to China widened the unfold between London and Shanghai metals in early commerce on Monday. Whereas LME aluminium spiked as a lot as 9.4 per cent, the response on SHFE was extra muted, with the rise in worth capped at 2.9 per cent in contrast with Friday’s shut.

Ukraine disaster: Chinese language oil, mining teams are early inventory market winners

Ukraine disaster: Chinese language oil, mining teams are early inventory market winners

The discrepancy may partly be as a result of merchants closing each LME quick positions, or bets that costs would fall in London, and lengthy positions on SHFE – bets they’d rise in Shanghai – to stem losses from a so-called reverse arbitrage commerce, stated Harry Jiang, head of buying and selling at Yonggang Assets.

As an alternative, the uneven will increase in worth are shutting the door on Chinese language imports of aluminium priced in {dollars}. That might make Russian steel, if priced in yuan and supplied at a reduction, extra enticing.

China has lengthy sought larger pricing energy over world commodities given its hefty reliance on imports. How that performs out for the Shanghai change is difficult by the brand new sanctions guidelines, which can permit previous Russian steel to proceed to be delivered to the LME, the world’s benchmark, in addition to to the Chicago Mercantile Alternate, the premier change within the US.

The world’s second-largest economic system began the yr on stable footing, as China’s factories revved up. Analysts warn that development can be powerful to take care of with out broader enchancment.

An unprecedented squeeze out there for copper ore has fired up bullish buyers and helped drive costs to the very best in practically two years.